Irs Form 843 Printable - This form is for income earned in tax year 2022, with tax returns due in april 2023. However, you cannot use form 843 to request a refund or an abatement of income tax. Web mailing addresses for form 843. The address shown in the notice. If you are an employer, you cannot use it to request abatement of fica tax, rrta tax, or income tax withholding. Scroll down to the claim/request information section. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Instructions for form 941 pdf Web employer's quarterly federal tax return. Then mail the form to….

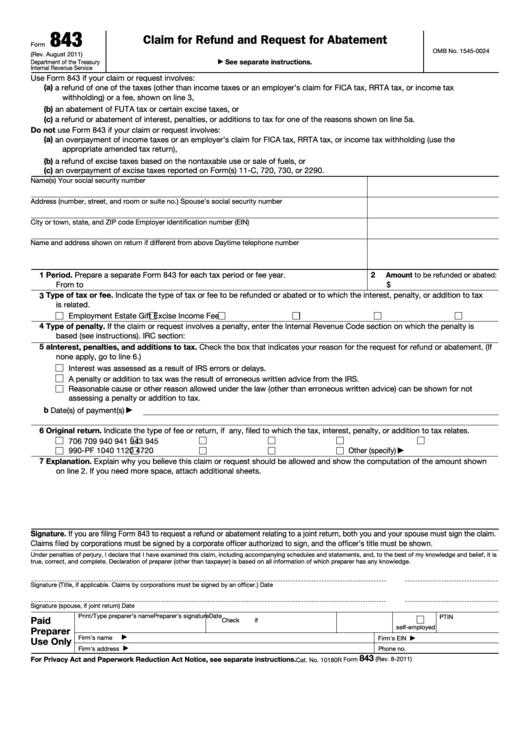

Fillable Form 843 Claim For Refund And Request For Abatement

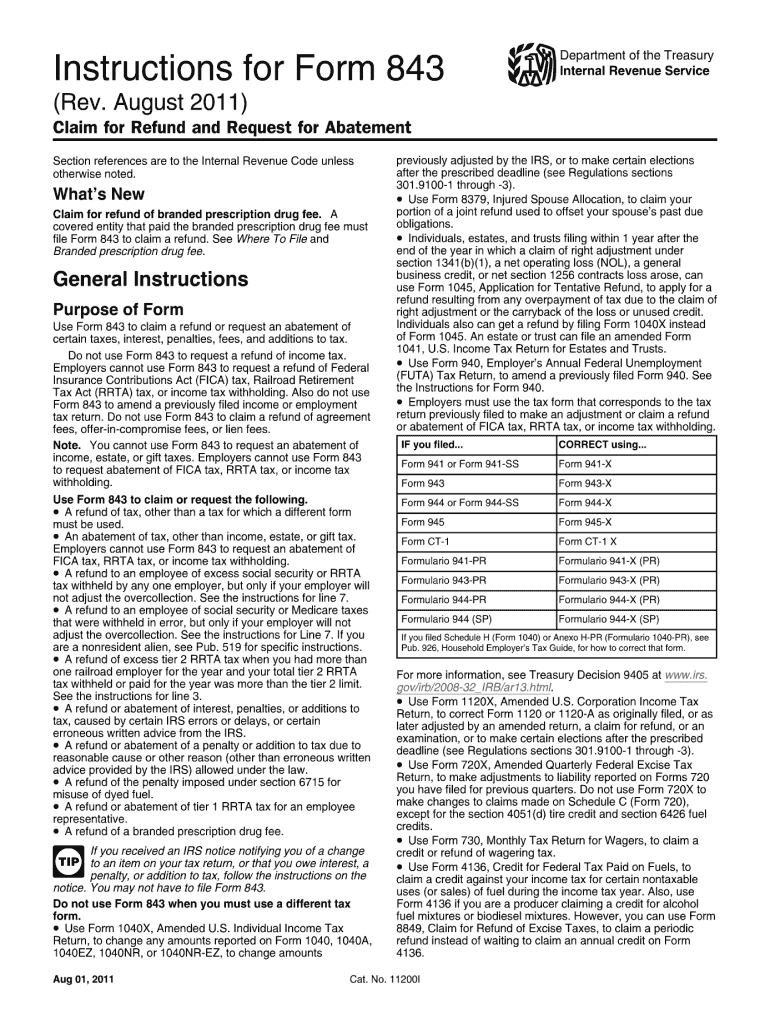

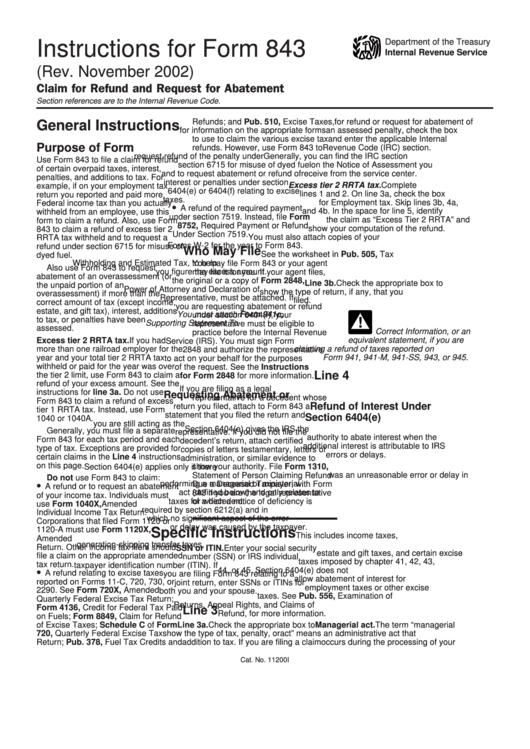

These include penalties for failure to pay, failure to file, and the failure of employers to make tax deposits as required by law. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. In response to an irs notice regarding a tax or.

IRS Form 8965 Download Fillable PDF or Fill Online Health Coverage

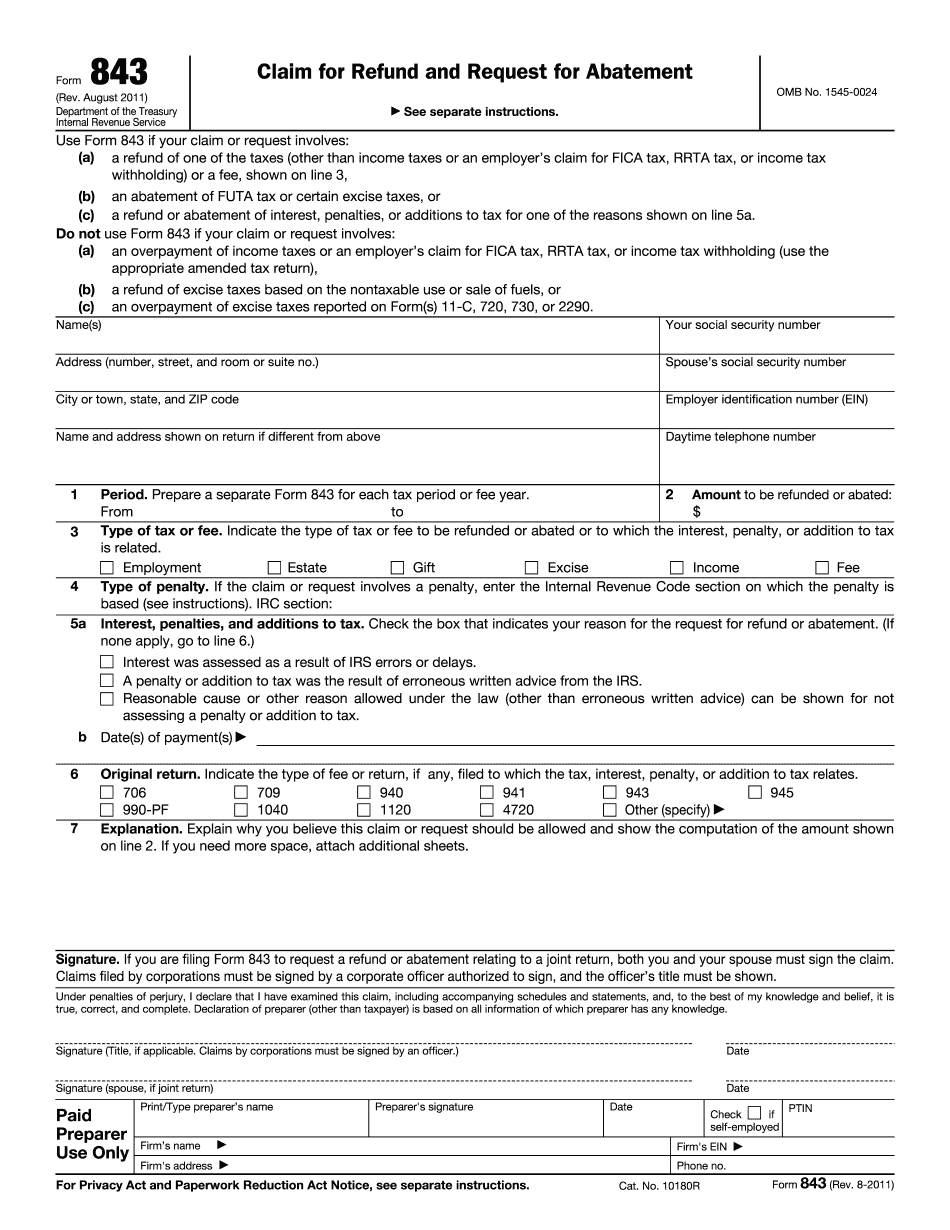

Enter the amount to be refunded or abated. A refund of one of the taxes (other than income taxes or an employer’s claim for fica tax, rrta tax, or income tax withholding) or a fee, shown on line 3, an. To request a claim for refund in a form 706/709 only tax matter. Web you can use form 843 to.

i843 Tax Refund Irs Tax Forms

These include penalties for failure to pay, failure to file, and the failure of employers to make tax deposits as required by law. If you are an employer, you cannot use it to request abatement of fica tax, rrta tax, or income tax withholding. Click on claim for refund (843). Web internal revenue service use form 843 if your claim.

Irs Form 843 Address Fill Out and Sign Printable PDF Template signNow

Web internal revenue service use form 843 if your claim or request involves: Scroll down to the claim/request information section. Web irs form 843 (request for abatement & refund): Enter the amount to be refunded or abated. More about the federal form 843 we last updated federal form 843 in february 2023 from the federal internal revenue service.

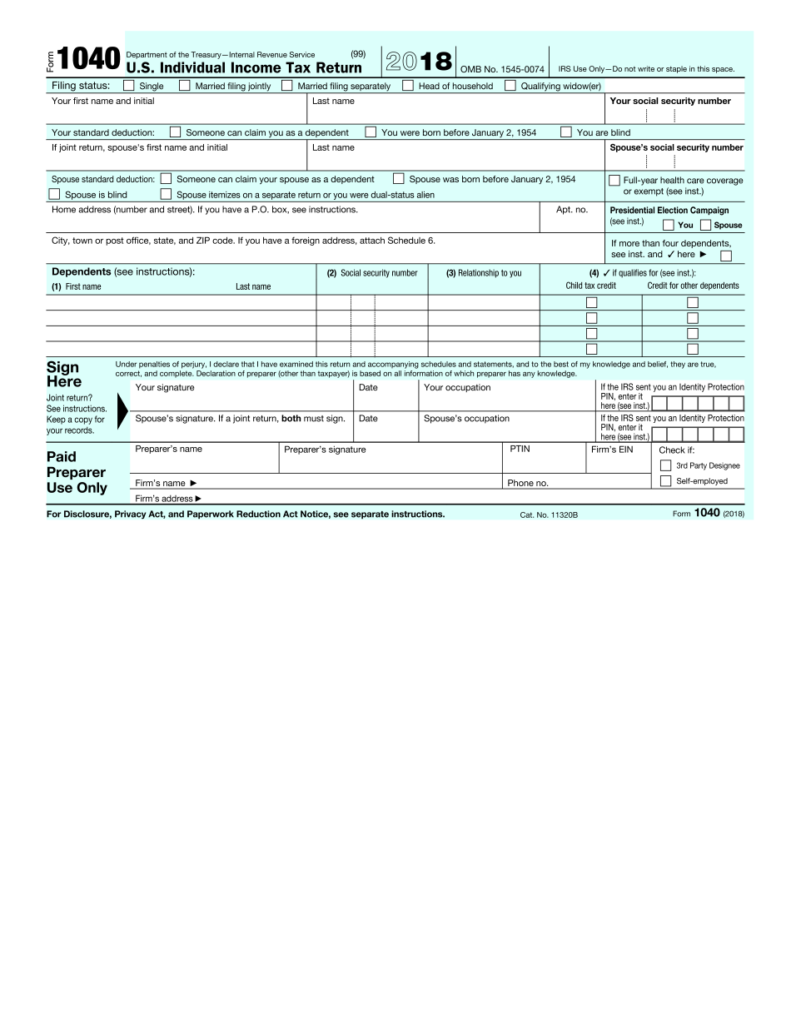

2018 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

The address shown in the notice. These include penalties for failure to pay, failure to file, and the failure of employers to make tax deposits as required by law. Purposes of irs form 843. This form is for income earned in tax year 2022, with tax returns due in april 2023. A refund of one of the taxes (other than.

Irs Form 843 Fillable and Editable PDF Template

Check the box print form 843 with complete return. If you are filing form 843. Enter the amount to be refunded or abated. In most cases, you can only get the interest erased if it’s related to an irs error or delay. Web mailing addresses for form 843.

Instructions For Form 843 Claim For Refund And Request For Abatement

If you are filing form 843. To request a claim for refund in a form 706/709 only tax matter. Check the box print form 843 with complete return. Instructions for form 941 pdf Web internal revenue service use form 843 if your claim or request involves:

IRS Form 843 Instructions Irs Tax Forms Tax Refund

More about the federal form 843 we last updated federal form 843 in february 2023 from the federal internal revenue service. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Then mail the form to…. Web internal revenue service use form 843.

IRS 1040 Form Fillable Printable In PDF 2021 Tax Forms 1040 Printable

Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate to your income tax return. Check the box print form 843 with complete return. Then mail the form to…. Web internal revenue service use form 843 if your claim or request involves: However, you cannot use form 843.

Std 843 Rev 5 2006 Fill and Sign Printable Template Online US Legal

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web internal revenue service use form 843 if your claim or request involves: Purposes of irs form 843. Web employer's quarterly federal tax return. If you are filing form 843.

Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. To request a claim for refund in a form 706/709 only tax matter. The address shown in the notice. This provision for forgiveness has been in place since 2001. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. More about the federal form 843 we last updated federal form 843 in february 2023 from the federal internal revenue service. Web mailing addresses for form 843. A refund of one of the taxes (other than income taxes or an employer’s claim for fica tax, rrta tax, or income tax withholding) or a fee, shown on line 3, an. These include penalties for failure to pay, failure to file, and the failure of employers to make tax deposits as required by law. Scroll down to the claim/request information section. Then mail the form to…. Web irs form 843 (request for abatement & refund): Web definition irs form 843 is a written request asking the government to waive certain penalties charged to taxpayers. Enter the amount to be refunded or abated. If you are filing form 843. You can use form 843 to request the irs to abate or erase certain taxes, penalties, fees, and interest. Instructions for form 941 pdf Web go to the input return tab. Web internal revenue service use form 843 if your claim or request involves: However, you cannot use form 843 to request a refund or an abatement of income tax.

In Response To An Irs Notice Regarding A Tax Or Fee Related To Certain Taxes Such As Income, Employment, Gift, Estate, Excise, Etc.

Click on claim for refund (843). However, you cannot use form 843 to request a refund or an abatement of income tax. Web irs form 843 (request for abatement & refund): Scroll down to the claim/request information section.

Employers Who Withhold Income Taxes, Social Security Tax, Or Medicare Tax From Employee's Paychecks Or Who Must Pay The Employer's Portion Of Social Security Or Medicare Tax.

Web mailing addresses for form 843. A refund of one of the taxes (other than income taxes or an employer’s claim for fica tax, rrta tax, or income tax withholding) or a fee, shown on line 3, an. This form is for income earned in tax year 2022, with tax returns due in april 2023. To request a claim for refund in a form 706/709 only tax matter.

Purposes Of Irs Form 843.

In most cases, you can only get the interest erased if it’s related to an irs error or delay. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. Web go to the input return tab. If you are filing form 843.

Web Employer's Quarterly Federal Tax Return.

If you are an employer, you cannot use it to request abatement of fica tax, rrta tax, or income tax withholding. Web internal revenue service use form 843 if your claim or request involves: Instructions for form 941 pdf The address shown in the notice.