Kansas W2 Form Printable - You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. Posted on february 12, 2021 by christine doucette. The amount of tax withheld should be reviewed each year and new forms should be filed whenever there is a change in either the marital status or number of exemptions of the individual. It lists the employee's taxable income and the amount and type of taxes that were withheld from paychecks during the calendar year just ended. Your employer may be required to send a copy of this form to the department of revenue. Web kansas employee’s withholding allowance certificate. (fillable.pdf format from the federal irs website) Once completed we suggest saving a copy on your computer or print a copy for your records. Sba.gov's business licenses and permits search tool allows you to get a listing of federal, state and local permits, licenses, and registrations you'll need to run a business. Print your first name and middle initial.

Kansas W2 Form Printable Printable Blank World

Web official website of the kansas department of revenue. Web all required forms need to be completed and returned to the kansas unemployment contact center as indicated on the form. Page last reviewed or updated: Copy a of this form is provided for informational purposes only. You may also print out copies for filing with state or local governments, distribution.

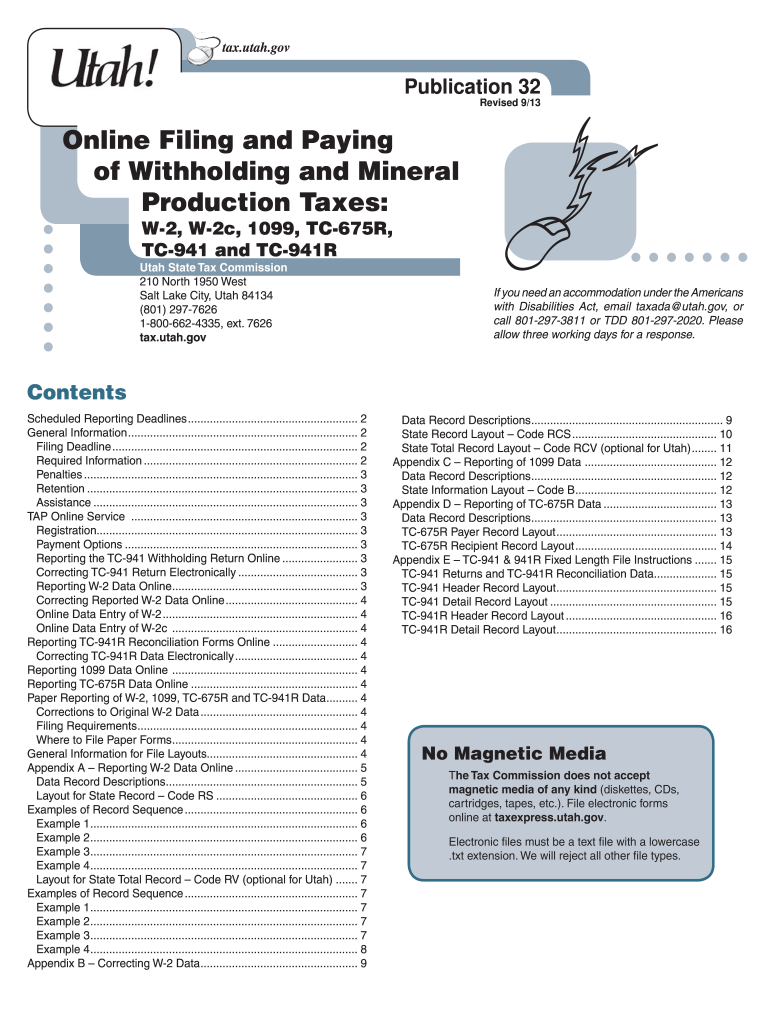

Utah W2 Form Fill Online, Printable, Fillable, Blank pdfFiller

Whether you are entitled to claim a certain number of allowances or exemption from withholding is subject to review by the kansas department of revenue. Copy a of this form is provided for informational purposes only. (fillable.pdf format from the federal irs website) Web official website of the kansas department of revenue. Web all required forms need to be completed.

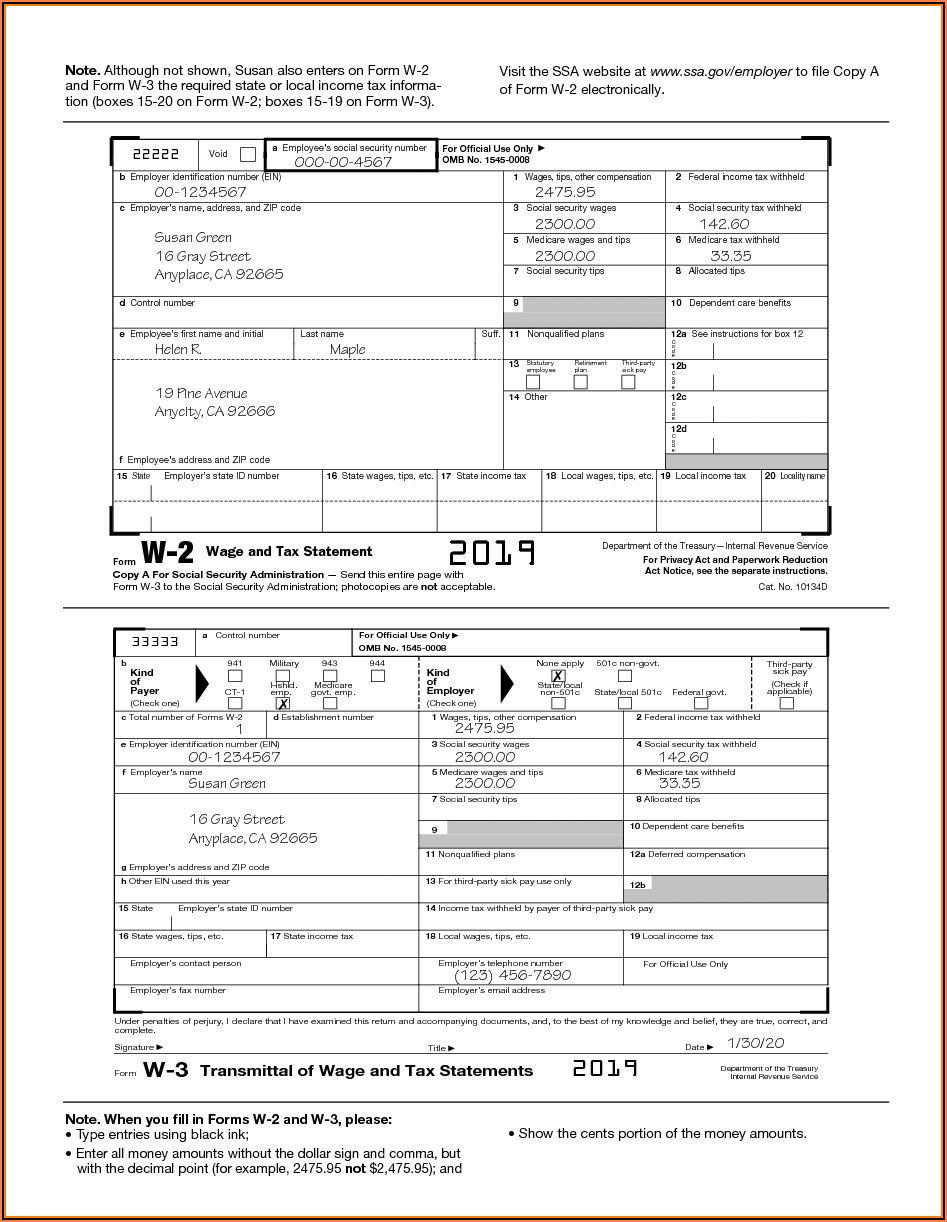

W4 Forms Online Printable W2 Forms 2022 W4 Form

Whether you are entitled to claim a certain number of allowances or exemption from withholding is subject to review by the kansas department of revenue. You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. Before submitting the form you must complete the fillable areas indicated in light blue.

Form IT2104 Employee's Withholding Allowance Certificate Fill Online

You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. It lists the employee's taxable income and the amount and type of taxes that were withheld from paychecks during the calendar year just ended. Employers reporting less than 51 records can file on paper but are encouraged to use.

All posts tagged 'printw2'

As an employer in the state of kansas, you must file. The amount of tax withheld should be reviewed each year and new forms should be filed whenever there is a change in either the marital status or number of exemptions of the individual. Sba.gov's business licenses and permits search tool allows you to get a listing of federal, state.

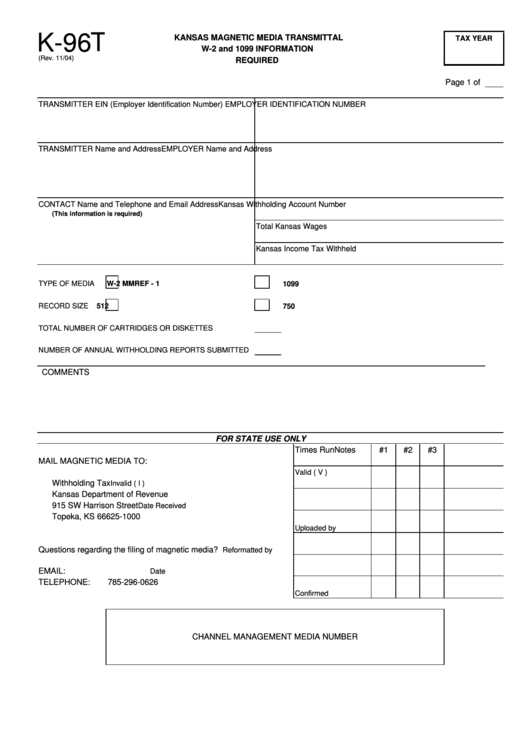

Form K96t Kansas Media Transmittal Required W2 And 1099

Copy a appears in red, similar to the official irs form. Employers reporting less than 51 records can file on paper but are encouraged to use our online. (fillable.pdf format from the federal irs website) Before submitting the form you must complete the fillable areas indicated in light blue boxes. Print your first name and middle initial.

W2 Form California Form Resume Examples 4x2vRz825l

The amount of tax withheld should be reviewed each year and new forms should be filed whenever there is a change in either the marital status or number of exemptions of the individual. You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. Your employer may be required to.

W2 Form Pdf Fill Out and Sign Printable PDF Template signNow

Once completed we suggest saving a copy on your computer or print a copy for your records. Web kansas employee’s withholding allowance certificate. You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. The amount of tax withheld should be reviewed each year and new forms should be filed.

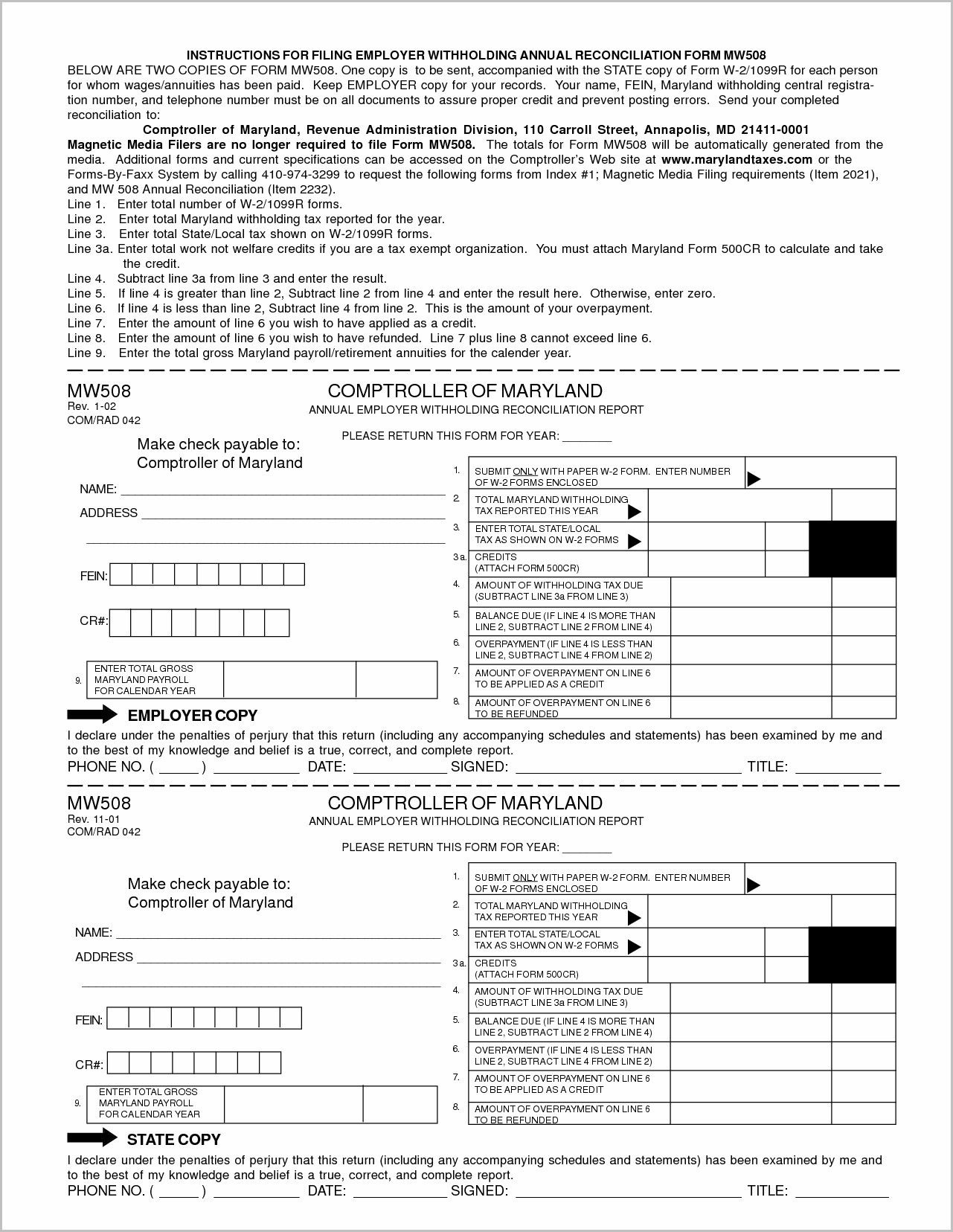

W9 Form Maryland Here’s Why You Should Attend W9 Form Maryland AH

The amount of tax withheld should be reviewed each year and new forms should be filed whenever there is a change in either the marital status or number of exemptions of the individual. Whether you are entitled to claim a certain number of allowances or exemption from withholding is subject to review by the kansas department of revenue. (fillable.pdf format.

W2 Form 2023

Employers reporting less than 51 records can file on paper but are encouraged to use our online. Web official website of the kansas department of revenue. Posted on february 12, 2021 by christine doucette. Web kansas employee’s withholding allowance certificate. Print your first name and middle initial.

Posted on february 12, 2021 by christine doucette. Whether you are entitled to claim a certain number of allowances or exemption from withholding is subject to review by the kansas department of revenue. Web all required forms need to be completed and returned to the kansas unemployment contact center as indicated on the form. Before submitting the form you must complete the fillable areas indicated in light blue boxes. Employers reporting less than 51 records can file on paper but are encouraged to use our online. Copy a appears in red, similar to the official irs form. You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. (fillable.pdf format from the federal irs website) Copy a of this form is provided for informational purposes only. Page last reviewed or updated: It lists the employee's taxable income and the amount and type of taxes that were withheld from paychecks during the calendar year just ended. Sba.gov's business licenses and permits search tool allows you to get a listing of federal, state and local permits, licenses, and registrations you'll need to run a business. As an employer in the state of kansas, you must file. Your employer may be required to send a copy of this form to the department of revenue. Print your first name and middle initial. Web kansas employee’s withholding allowance certificate. Once completed we suggest saving a copy on your computer or print a copy for your records. Web official website of the kansas department of revenue. The amount of tax withheld should be reviewed each year and new forms should be filed whenever there is a change in either the marital status or number of exemptions of the individual.

Print Your First Name And Middle Initial.

Web official website of the kansas department of revenue. Copy a appears in red, similar to the official irs form. The amount of tax withheld should be reviewed each year and new forms should be filed whenever there is a change in either the marital status or number of exemptions of the individual. Copy a of this form is provided for informational purposes only.

(Fillable.pdf Format From The Federal Irs Website)

Employers reporting less than 51 records can file on paper but are encouraged to use our online. Once completed we suggest saving a copy on your computer or print a copy for your records. Sba.gov's business licenses and permits search tool allows you to get a listing of federal, state and local permits, licenses, and registrations you'll need to run a business. Before submitting the form you must complete the fillable areas indicated in light blue boxes.

Posted On February 12, 2021 By Christine Doucette.

Your employer may be required to send a copy of this form to the department of revenue. It lists the employee's taxable income and the amount and type of taxes that were withheld from paychecks during the calendar year just ended. As an employer in the state of kansas, you must file. Page last reviewed or updated:

Web Kansas Employee’s Withholding Allowance Certificate.

Web all required forms need to be completed and returned to the kansas unemployment contact center as indicated on the form. Whether you are entitled to claim a certain number of allowances or exemption from withholding is subject to review by the kansas department of revenue. You may also print out copies for filing with state or local governments, distribution to your employees, and for your records.