Printable Wisconsin 1099 Form - Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Please read to see if you qualify. For more information, see publication 117 , guide to. Requesting previously filed tax returns. Complete all required information for. Sign up now to go paperless. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to www.irs.gov/formw9 for. Web for mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (ira), and generally,. The state of wisconsin also mandates the. A person is not an.

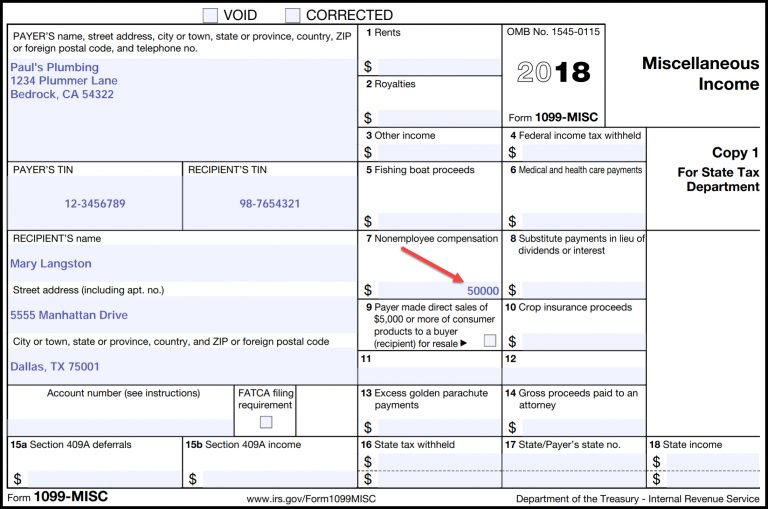

IRS Form 1099 Reporting for Small Business Owners

Web dorcommunications@wisconsin.gov or 608.266.2300. This is wisconsin's form for reporting federal income tax. Now we need to print the 1099 form (print form 1099 misc). The state of wisconsin also mandates the. Complete all required information for.

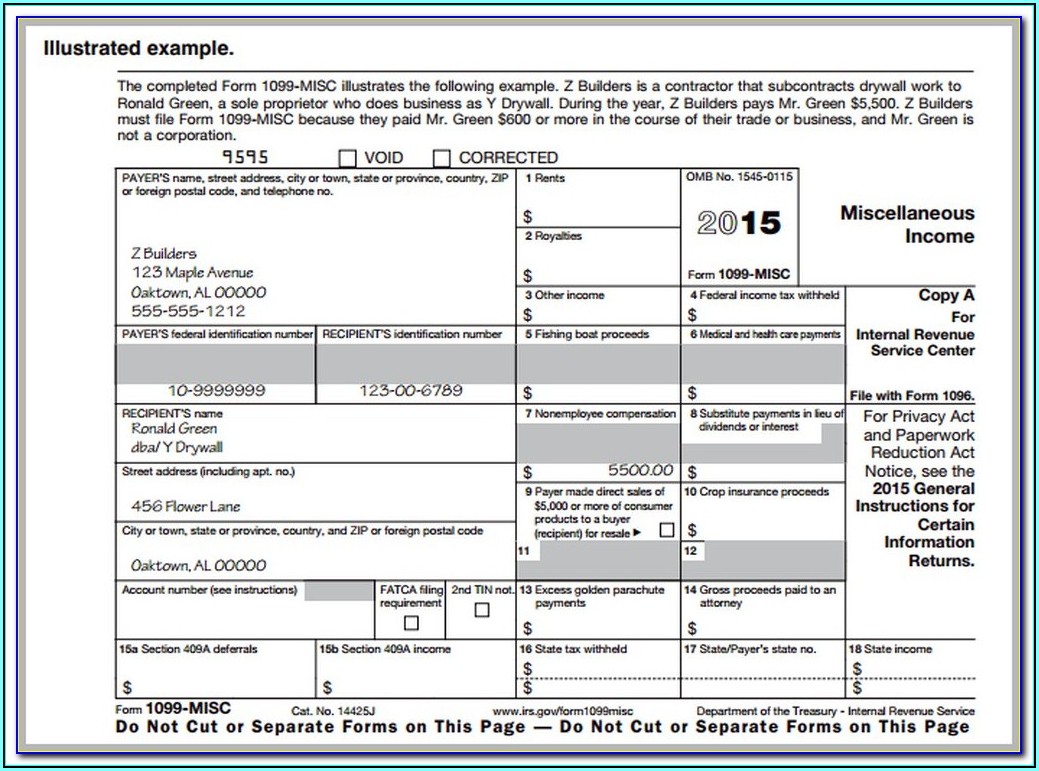

Forms 1099 The Basics You Should Know Kelly CPA

Web get the wisconsin w2 sheet completed. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to www.irs.gov/formw9 for. Check on your refund other tax links internal revenue service other. Irs approved tax1099 allows you. Web wisconsin department of revenue:

Irs Form 1099 Reporting For Small Business Owners Free Printable 1099

Download your adjusted document, export it to the cloud, print it from the editor, or share it with other people via a shareable link or as an. The state of wisconsin also mandates the. My.unemployment.wisconsin.gov log on using your username and password. Requesting previously filed tax returns. Web dorcommunications@wisconsin.gov or 608.266.2300.

1099 Form Fillable Pdf Form Resume Examples Wk9yWNXV3D

The internal revenue service requires. It provides your annual refund or overpayment credit information. My.unemployment.wisconsin.gov log on using your username and password. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to www.irs.gov/formw9 for. For more information, see publication 117 , guide to.

View Form Ssa 1099 Online Universal Network

A person is not an. The state of wisconsin also mandates the. Check on your refund other tax links internal revenue service other. Irs approved tax1099 allows you. Now we need to print the 1099 form (print form 1099 misc).

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

Irs approved tax1099 allows you. This is wisconsin's form for reporting federal income tax. For more information, see publication 117 , guide to. My.unemployment.wisconsin.gov log on using your username and password. Web get the wisconsin w2 sheet completed.

Wisconsin Retirement System Form 1099 R Universal Network

October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to www.irs.gov/formw9 for. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. For more information, see publication 117 , guide to. Please read to see if you qualify. The state of wisconsin also mandates the.

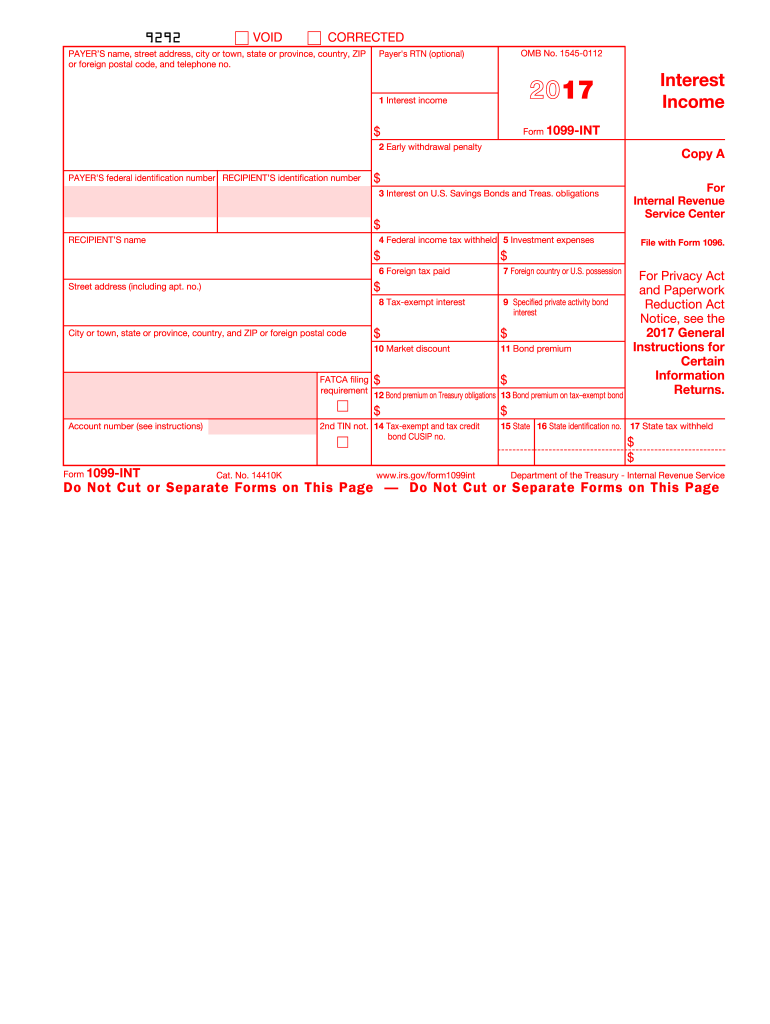

2017 Form IRS 1099INT Fill Online, Printable, Fillable, Blank pdfFiller

Now we need to print the 1099 form (print form 1099 misc). Web for mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (ira), and generally,. It provides your annual refund or overpayment credit information. The state of wisconsin also mandates the. Sign up now to go paperless.

Wisconsin Form 1099 Filing Universal Network Free Nude Porn Photos

This is wisconsin's form for reporting federal income tax. A person is not an. It provides your annual refund or overpayment credit information. Complete all required information for. The internal revenue service requires.

What is a 1099 & 5498? uDirect IRA Services, LLC

Web wisconsin department of revenue: My.unemployment.wisconsin.gov log on using your username and password. A person is not an. Complete all required information for. Web dorcommunications@wisconsin.gov or 608.266.2300.

Irs approved tax1099 allows you. Sign up now to go paperless. Web dorcommunications@wisconsin.gov or 608.266.2300. Download your adjusted document, export it to the cloud, print it from the editor, or share it with other people via a shareable link or as an. Web for mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (ira), and generally,. Click on the print button, this will bring up the 1099 print dialog, where you can select the different 1099. My.unemployment.wisconsin.gov log on using your username and password. It provides your annual refund or overpayment credit information. The internal revenue service requires. Check on your refund other tax links internal revenue service other. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to www.irs.gov/formw9 for. For more information, see publication 117 , guide to. Complete all required information for. Web wisconsin department of revenue: Now we need to print the 1099 form (print form 1099 misc). Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. A person is not an. Web get the wisconsin w2 sheet completed. The state of wisconsin also mandates the. Please read to see if you qualify.

It Provides Your Annual Refund Or Overpayment Credit Information.

This is wisconsin's form for reporting federal income tax. Please read to see if you qualify. Click on the print button, this will bring up the 1099 print dialog, where you can select the different 1099. Irs approved tax1099 allows you.

Complete All Required Information For.

Web dorcommunications@wisconsin.gov or 608.266.2300. Sign up now to go paperless. A person is not an. Now we need to print the 1099 form (print form 1099 misc).

For More Information, See Publication 117 , Guide To.

Check on your refund other tax links internal revenue service other. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Web wisconsin department of revenue: The state of wisconsin also mandates the.

Web For Mortgage Interest Paid, Acquisition Or Abandonment Of Secured Property, Cancellation Of Debt, Contributions To An Individual Retirement Arrangement (Ira), And Generally,.

My.unemployment.wisconsin.gov log on using your username and password. Download your adjusted document, export it to the cloud, print it from the editor, or share it with other people via a shareable link or as an. Web get the wisconsin w2 sheet completed. The internal revenue service requires.