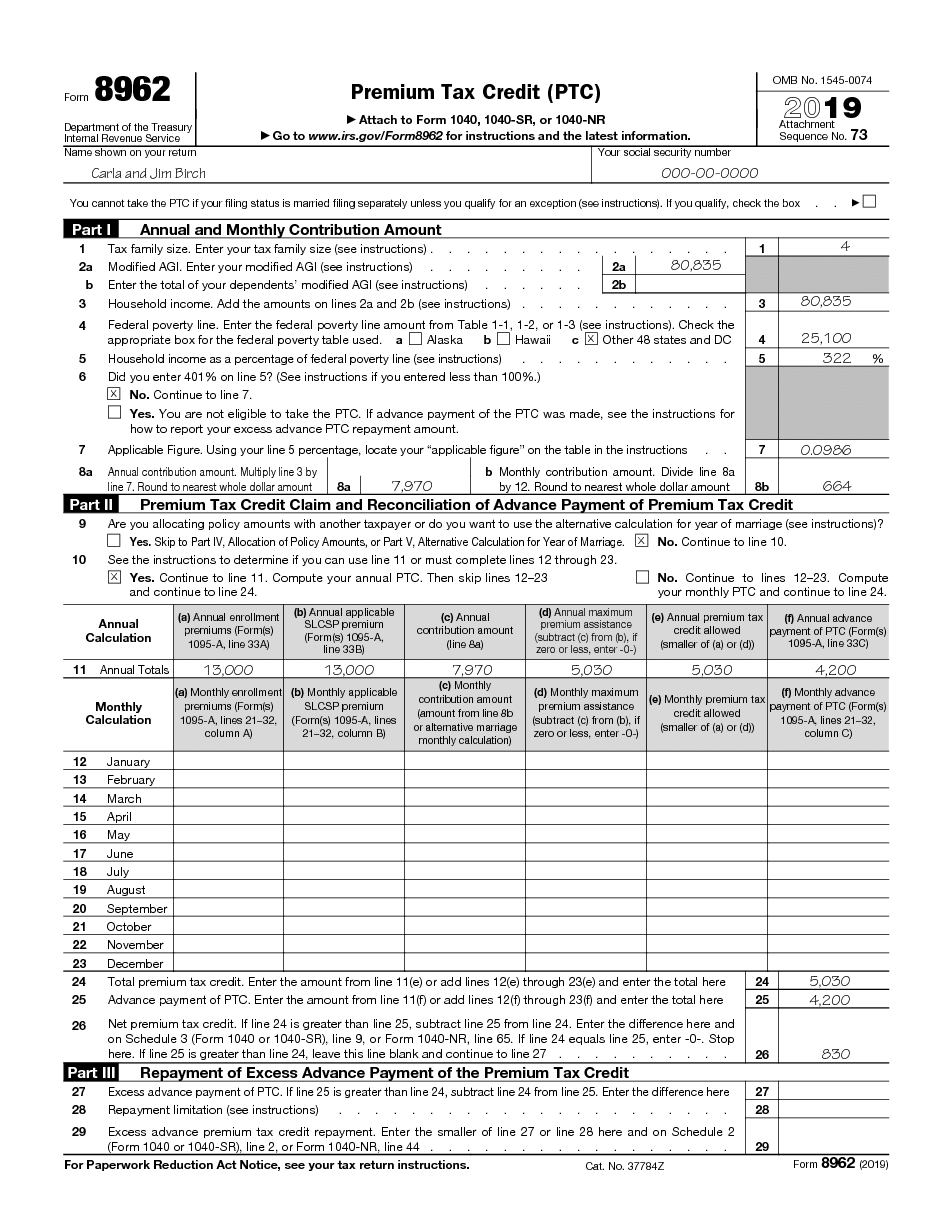

Tax Form 8962 Printable - Web a list of all the tax deductions and tax credits claimed in the tax return. Qualified small employer health reimbursement arrangement (qsehra). Web print form 8962 (pdf, 110 kb) and instructions (pdf, 348 kb). We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. You can print other federal tax forms here. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. Web get printable & fillable irs form 8962 sample for 2020 ☑️ how to fill out form 8962 instructions ☑️ all blank template blanks in pdf, doc, rtf and jpg ☑️ tips and guides. Web form 8962, premium tax credit if you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with your federal income tax return. Any other documents requested by the irs (for example, a copy of the foreign tax return or a foreign bank statement). 73 name shown on your return your social security number a.

IRS 8962 Form Printable 2020 📝 Get Tax Form 8962 Printable Blank in PDF

Web we last updated federal form 8962 in december 2022 from the federal internal revenue service. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Go to www.irs.gov/form8962 for instructions and the latest information. Form 8962 blank template to print & fill out before.

Fillable Tax Form 8962 Universal Network

Select the information you need to get details: Qualified small employer health reimbursement arrangement (qsehra). Web form 8962, premium tax credit if you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with your federal income tax return. Any other documents requested by the irs (for example, a.

Form 8962 Edit, Fill, Sign Online Handypdf

Web get printable & fillable irs form 8962 sample for 2020 ☑️ how to fill out form 8962 instructions ☑️ all blank template blanks in pdf, doc, rtf and jpg ☑️ tips and guides. Web get 8962 form 2020 form 8962 instructions, premium tax credit score form 8962 irs form 8962 8962 form tax form 8962 print form 8962 8962.

Irs form 8962 Aca Irs form 8962 for ‘premium Tax Credits’ Successfully

Select the information you need to get details: Web get 8962 form 2020 form 8962 instructions, premium tax credit score form 8962 irs form 8962 8962 form tax form 8962 print form 8962 8962 form print 8962 form 8962 form care printable sample fill online instructions online additional information on 8962 form instructions Web form 8962, premium tax credit if.

Instructions for IRS Form 8962 Premium Tax Credit (ptc) Download

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web form 8962, premium tax credit if you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with your federal income tax return..

What Individuals Need to Know About the Affordable Care Act for 2016

Web we last updated federal form 8962 in december 2022 from the federal internal revenue service. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Web form 8962, premium tax credit if you had marketplace insurance and used premium tax credits to lower.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Web we last updated federal form 8962 in december 2022 from the federal internal revenue service. 73 name shown on your return your social security number a. Web a list of all the tax deductions and tax credits claimed in the tax return. Web get printable & fillable irs form 8962 sample for 2020 ☑️ how to fill out form.

Fillable Tax Form 8962 Universal Network

Go to www.irs.gov/form8962 for instructions and the latest information. Any other documents requested by the irs (for example, a copy of the foreign tax return or a foreign bank statement). You’ll use this form to “reconcile” — to find out if you used more or less premium tax credit than you qualify for. Web form 8962, premium tax credit if.

Form 8962 Edit, Fill, Sign Online Handypdf

You’ll use this form to “reconcile” — to find out if you used more or less premium tax credit than you qualify for. Reminders applicable federal poverty line percentages. Web a list of all the tax deductions and tax credits claimed in the tax return. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions.

2019 Form IRS Instructions 8962 Fill Online, Printable, Fillable, Blank

You’ll use this form to “reconcile” — to find out if you used more or less premium tax credit than you qualify for. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Qualified small employer health reimbursement arrangement (qsehra). We will update this.

You can print other federal tax forms here. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web print form 8962 (pdf, 110 kb) and instructions (pdf, 348 kb). Web we last updated federal form 8962 in december 2022 from the federal internal revenue service. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. Web get printable & fillable irs form 8962 sample for 2020 ☑️ how to fill out form 8962 instructions ☑️ all blank template blanks in pdf, doc, rtf and jpg ☑️ tips and guides. Web get 8962 form 2020 form 8962 instructions, premium tax credit score form 8962 irs form 8962 8962 form tax form 8962 print form 8962 8962 form print 8962 form 8962 form care printable sample fill online instructions online additional information on 8962 form instructions You’ll use this form to “reconcile” — to find out if you used more or less premium tax credit than you qualify for. Reminders applicable federal poverty line percentages. Select the information you need to get details: Qualified small employer health reimbursement arrangement (qsehra). Web a list of all the tax deductions and tax credits claimed in the tax return. Web form 8962, premium tax credit if you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with your federal income tax return. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Go to www.irs.gov/form8962 for instructions and the latest information. Form 8962 blank template to print & fill out before file. Any other documents requested by the irs (for example, a copy of the foreign tax return or a foreign bank statement). Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. 73 name shown on your return your social security number a.

Web Get 8962 Form 2020 Form 8962 Instructions, Premium Tax Credit Score Form 8962 Irs Form 8962 8962 Form Tax Form 8962 Print Form 8962 8962 Form Print 8962 Form 8962 Form Care Printable Sample Fill Online Instructions Online Additional Information On 8962 Form Instructions

Web print form 8962 (pdf, 110 kb) and instructions (pdf, 348 kb). Web a list of all the tax deductions and tax credits claimed in the tax return. 73 name shown on your return your social security number a. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Reminders applicable federal poverty line percentages. Any other documents requested by the irs (for example, a copy of the foreign tax return or a foreign bank statement). Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web get printable & fillable irs form 8962 sample for 2020 ☑️ how to fill out form 8962 instructions ☑️ all blank template blanks in pdf, doc, rtf and jpg ☑️ tips and guides.

Select The Information You Need To Get Details:

Qualified small employer health reimbursement arrangement (qsehra). Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. Web we last updated federal form 8962 in december 2022 from the federal internal revenue service. Web form 8962, premium tax credit if you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with your federal income tax return.

You’ll Use This Form To “Reconcile” — To Find Out If You Used More Or Less Premium Tax Credit Than You Qualify For.

Form 8962 blank template to print & fill out before file. You can print other federal tax forms here. Go to www.irs.gov/form8962 for instructions and the latest information. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022.